|

Big Cap tech took a slamming on Friday's session, with some of the biggest companies in America getting slammed. Intel, Google and Oracle were three that took a particularly bad beating. What does it mean going forward? Is the sell-off over? Was this a temporary blip?

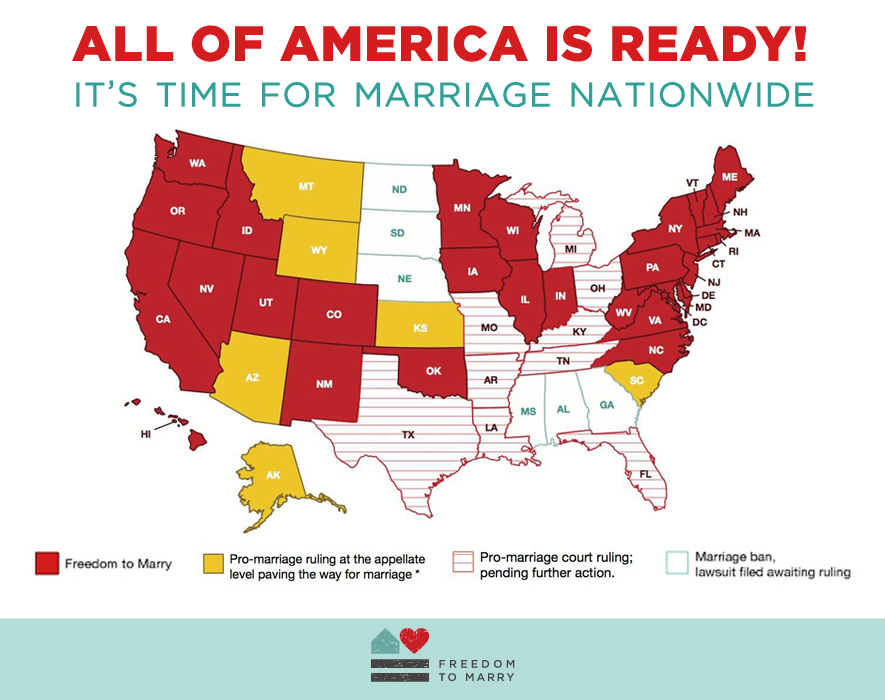

Watch the 4300 level on the Nasdaq, which sits on the 200 Day Moving Average. The Index must trade above that level to be 'out of the woods' and declare the sell-off over. Any more selling could lead to a real 'rout' in the market. It's been a busy week in the courts and now I have to re-post the update on the status of Marriage equality throughout America. So many court rulings made altering the landscape, so here is the updated map. Where does your state stand on Equality? If your state isn't shaded in Red- get involved. Contact your Senators and demand equality!

I posted the early chart of Google, which showed weakness and I said if the stock didn't recover the 200 Day moving average that 550 would come into play. Well, this chart was posted just before 11 this morning. Then, in late session trading, Google really tanked. The stock closed just above 555 on huge volume. It's a signal to me that 'smart' money took capital off the table and put it into their pockets for safe keeping. I always watch market leaders for this reason - it gives you a glimpse as to what market insiders think about the current state of stocks. At this moment - the smart money sold today.

|

THE TERRORIST OF PROVIDENCE STREETSERVEREXCERPT FROM SERVER

|